How to manage the unwinding of Non-Core Assets?

Non-Core Assets, Fatality or Opportunity?

With the COVID19 we are in front of a paradigm shift in the worldwide economic environment. Subject to the length and intensity of the lockdown, Europe is facing an unprecedented economic recession not seen since the end of WWII.

In this context, how should Non-Core Asset players react?

Through this article, I will try to highlight, starting from the current market state, the challenges & risks faced by the Non-Core Assets players, as well as some of the measures and steps necessary to tackle the COVID19 consequences and opportunities generated.

- An Outlook of Top EU Banks toxic assets (0)

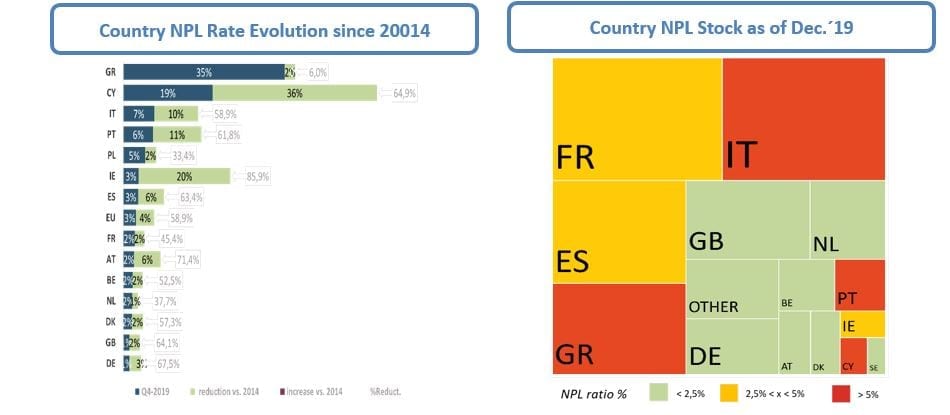

Since the 2014 peak, EU banks, pushed by the regulators and governments, have improved the quality of their loan book, reducing their NPL stock by 47%, their NPL ratio to 2.7% (down by 393bps) as well as their Forbearance Book to 1.9% (as of Dec.´19). Their coverage ratio has been increased up to 44.7% and they are better capitalized with a historical high CET1 (14.8% FL).

However, efforts are far from over!

The NPL book still amounts to over €584bn across Europe with 34 banks struggling with NPL books over €5bn (BNP Paribas with €36,5bn having the highest volume). The majority of EU Countries are still above pre-crisis NPL rates (13 countries having an NPL ratio above the EU average).

- Post-COVID19, what should we expect and how tackle NPAs in a transformed environment?

The degree or severity of the impact will depend on the way each player handles the crisis, and by that, I mean the effectiveness of the mitigation measures they will implement.

- Regulators/supervisors:

As per measures already announced, governments and regulators across Europe are (1) increasing monetary, fiscal and economic stimulus, (2) relaxing capital and liquidity requirements and (3) smoothing regulatory requirements. As the extent of the COVID19 Crisis impact is still unknown we should expect additional measures to be implemented in both the short and medium terms.

Looking forward, in order to create measures of restraint for the expected NPA inflows, the ECB/EBA may (1) look for generalizationof early warning signals tools, (2) request ad-hoc reporting related to the follow up of the COVID19 measures provided, (3) require detailed NPA strategy and operating plan for the most affected Banks / Countries, and (4) set-up of specific focus Asset Management Companies. We should also expect (5) an acceleration of banking consolidation process, to absorb those entities which are today too weak alone to face the COVID19 outcome.

- Banks:

In order to control and reduce the expected post-COVID19 NPA flows, Banks should anticipate inflow, manage stage2 proactively, stop transition flows and accelerate outflow.

One of the first tasks EU Banks should be focused on after lockdown ends is the implementation of measures to anticipate and create barriers for the generation of new NPA inflows with a mid-to-long term viewpoint, reevaluating their risk profile / appetite but also implementing standardized mitigation measures. Banks should be Client focused, containing defaults in order to bring borrowers back to normality in the shortest term possible while maintaining open the credit flow.

However, Banks should still expect a relevant increase of NPA New Inflows in the medium term and be ready to handle it. Post-2008, EU Banks faced a peak of their NPL rate up to 40.9x pre-crisis level, still not offset on most EU countries (e.g. 9.8x in Greece @35,2%).

To call on an example, assuming just a 25% of the 2008 peak increase, the EU NPL rate could reach 3.8% over a 2 to 3-year period (+1pps vs. Dec.´19; constant total loan book value) with a volume increasing by +€200bn up to €780bn (1.3x YE19 Stock).

All EU banks´ strategies should be headed to active management, building up an NPA strategy and operational governance, especially the ones with a relevant Legacy book.

At the same time, Banks will need to pursue managing their Legacy portfolio to the downside, with France, Italy and Spain (€315bn or 54% EU stock) highly impacted by the Sanitary Crisis.

By using the capital flexibility granted by the regulator and their P&L to absorb losses, Banks should pursue the legacy work-out, accelerating transactions by the end of ´20, early ´21. However, Banks should expect future transactions to suffer an increased gap on pricing offering, considering market uncertainty, volatility and change of investors assumptions.

- Investors:

Non-Core Asset Investors have been highjacked in the middle/early stages of their divestment process (e.g. Spanish portfolios purchased in 2017-´18 or Greek transactions in 2019). They won’t meet their business plan!

In the short term, they should expect a drying up of the cash flow pipeline due to the lockdown and a resulting collection void impacting the cash flow generation of their portfolios. They should also expect governments´ protective measures which will, temporarily and under certain conditions, stop/forbid servicers from executing work-out measures impacting timing & recovery expectations.

Investors should expect adverse operational constraints, longer work-out processes / time to resolution & recovery all with lower exit values or sale proceeds, i.e. divestment duration will potentially take between 5 to 7 years vs. 3 to 4 pre-COVID19.

With that in mind, Investors will need to (1) redefine over the next couple of months their portfolio strategy & business plan across the full divestment cycle, including a what-if scenario analysis. Their reset strategy´s execution should be driven, at least initially, by managing liquidity/cash-flow and timing (including their own funding) without forgetting the value adding/harvesting approach.

They will also need to (2) execute mitigation measures to smooth the post-COVID19 impact on their portfolio. And in order to offset some of the operating cost increases which are implied by the lengthening of their divestment strategy, they will have to (3) implement performance improvement/ restructuring measures on their operational management.

On the other hand, Non-Core Assets are cyclical and opportunistic investments. Investors should expect (1) new transactional opportunities by the late ´20 or early ´21 and beyond, (2) with more conservative assumptions coupled with restrictive leveraging conditions, and with (3) accrued volume and extended market lifetime. Additionally, for Investors with captive servicers they should expect (4) an increase in Asset Under Management, driven by the extended lifespan of their portfolios, new portfolios transactions and new-inflows through 3rd party servicing contracts with Banks and their potential “droits de suite”.

- Servicers:

The crisis will also impact significantly the NPA Servicing industry and their business model.

In the short-to-midterm, Servicers should expect (1) a drying-up of their work-out and REO sales pipeline as a consequence of the lockdown and its immediate effects, (2) delays in the execution of legal proceedings with implementation of protective measures, (3) a drop in demand for real estate assets and a reduction of the recovery percentage due to worsening economic environment, (4) drop of real estate buyers ratings, generating difficulties to find financing and execute sales and (5) renegotiation of asset management fee structures by their clients.

To summarize: they are headed toward a strong reduction in their capacity to generate income for their clients as well as for themselves.

Servicers will need to set a clear roadmap to manage NPAs in the post-COVID19 environment. From a strategy perspective, they will have to (1) review all their portfolios under management, (2) assess the impact of the COVID19 on each exposure/asset class, (3) redefine the business plan and the operational approach and (4) analyze the financial impact across the full disinvestment cycle for their investors and their P&L. From an operational perspective, they will need to (1) implement cost management measures without jeopardizing their management capacities or the continuity of service, (2) prioritize resources and capabilities, maximizing value creation and optimizing time to exit, (3) deploy a more efficient and effective structure.

At the same time, the COVID19 crisis will generate an increased timeline and volume visibility of AUM, expanding the lifetime of current portfolios by 2 to 3 years and changing market paradigm from winddown of set books to new inflow and new market transactional opportunities.

Non-Core Assets: An Opportunity!

Better prepared than for the 2008 Crisis with regulators and financial institutions´ NPA aware, consolidated players and work-out established capabilities.

Still struggling with the 2008 aftershocks with €600bn NPL stock, investors in the middle stages of their disinvestment process and countries with relatively new servicing industry

Need to transform NPA strategy and organization´s mindset to a post-COVID19 environment