The year 2021 got off to the best start possible as far as real estate market transactions are concerned. The first month of the year, which forecasters had predicted would be a turning point in the Covid-19 crisis with the arrival of the much hoped for vaccine, was initially defined by a setback as Portugal once again went into a partial lockdown. Even so, the real estate market held on strong, showing its continued resilience, a word that has been much used to describe the sector throughout these last months of the pandemic. Proof of the market’s strength can be easily found amongst the slew of new investments in offices, tourism, logistics and housing.

One report that reverberated around the national market was the news that half the population of Portugal (homeowners in 84 Portuguese municipalities) will benefit from a reduction in their property tax (IMI) rate in 2021, thereby seeing a drop in payments related any properties owned on December 31st, 2020. The news stemmed from a list of IMI rates sent to the country’s Tax and Customs Authority by the municipalities.

As Aura Ree Portugal led valuations of portfolios of non-performing loans (NPLs) in 2020, the year showed that the Portuguese market remained dynamic, with banks looking to sell portfolios of NPLs and REOs (Real Estate Owned Assets). The year began with BPI finalising the sale of Project Lime to LX Partners at the end of January. The assets, which will now be controlled by funds managed by LX Investment Partners SARL, have a gross value of approximately 300 million euros, including roughly 30,000 loan contracts.

Housing

Mondego Capital Partners enlarged its portfolio of real estate developments with its acquisition of €45 million in new projects. The firm’s investment aims to develop luxury residential projects in the centre of the Portuguese capital, in areas such as Chiado, Marquês de Pombal and Baixa de Lisboa.

Socicorreia, in partnership with the AFA Group, acquired two adjacent residential buildings in the centre of Lisbon. Neither the sales price nor the name of the international seller were disclosed. The buildings are unoccupied, will undergo significant renovations. The buildings are in one of the most sought after and valued neighbourhoods in Lisbon.

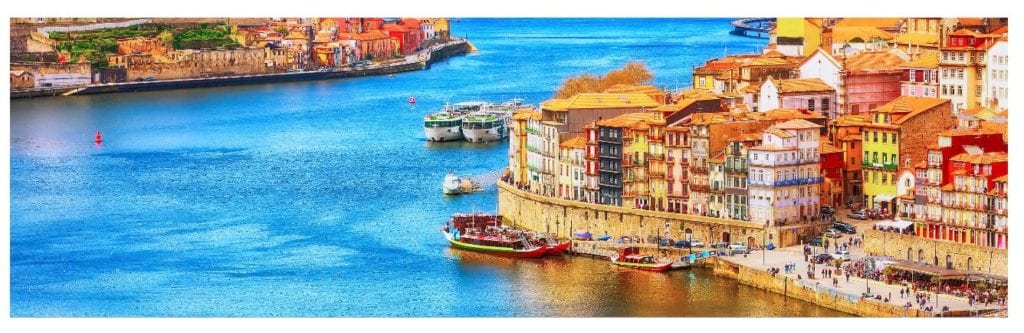

During the first two weeks of the new year, the municipality of Porto announced that it would invest more than 63 million euros in its Monte Pedral project. In addition to the planned 330 new flats, the project will include shops, services, and a student residence.

Also in January, in a project estimated at over 60 million euros and which will start in February, the developer Avenue acquired the former CUF Infante Santo Hospital in Lisbon and plans to convert the site into an 87-flat luxury condominium. The Villa Infante project, designed by Frederico Valsassina, aims to transform the space into a closed condominium with a more than 3,000-m2 garden.

RAR Imobiliária began work on its Novo Parque development in Matosinhos, betting on a new concept of disruptive flats and contemporary design and decorative techniques. The developer will invest approximately 25 million euros in the project near the City Park. Construction is forecast to take about 26 months.

Rio Capital announced that it plans to invest 65 million euros in residential projects in Greater Lisbon by 2022. Since arrival in Portugal two years ago, Rio Capital has already developed six projects, with a total construction area of approximately 30,000 m2.

Logistics and offices

In a partnership with the Polish real estate consulting group AXI IMMO, Altamira Asset Management Portugal completed its sale of assets in Poland to a major international investor that specialises in the development of logistics assets. The asset consists of a 20,000 square metre warehouse and a nearly 16-hectare plot of land for potential expansion. The value of the transaction was not disclosed.

The Israeli group Fortera will invest approximately 70 million euros in the new Business and Tourism Centre in the southern region of Espinho. The “Espinho Business Centre” project will include housing, shops, services and hotels.

The VGP group acquired a plot of land in Sintra to build VGP Park Sintra, in a 12-million-euro investment. The land, which has more than 27,000 square metres of surface area, has a unique location in terms of access and will have a gross leasable area reaching 13,000 square metres.

AM Alpha announced its acquisition of a portfolio of offices in Portugal, though it declined to disclose the transaction’s value. The “Beatles” office portfolio, as it is called, consists of three office buildings in Lisbon (two on Avenida José Malhoa and one on Picoas Plaza) and one in Vila Nova de Gaia.

Millennium BCP sold the Oriente Multipurpose building to Orion European Real Estate Fund V, an investment fund managed by Orion Capital Managers for an undisclosed amount. The building in Parque das Nações, Lisbon, has a total of 37,000 m² of offices under construction and should be completed by the end of 2022.

The investment firm Mabel Capital finalised the purchase of an office building in Lisbon’s centre from a major Portuguese bank for an undisclosed amount. The 14-floor building occupies an area of 5,000 square metres, with nine floors of offices, five floors of underground parking and an auditorium.

Tourism

After a year of unprecedented crises which punished the tourism sector particularly severely, investment enthusiasm is once again building in early 2021, as evidenced by a series of significant announcements in January.

The latest development in Vilamoura, the Dom Pedro Residences will be the target of a total investment of 22 million euros. The residential project has an excellent location on the seafront near the walkway that connects Vilamoura to Quarteira, in the Algarve.

Caxias will become the home to the 4-star Hotel Mónaco in a €13-million investment. The site, which is being developed by Terraços Cintilantes and designed by Mezia Arquitectos, faces the sea and the waterfront. The future hotel will have a gross construction area of approximately 3,650 m2 over five floors.

Inspire Capital announced that it is building Ericeira’s first 5-star hotel in a five million euro investment. The new, 35-room hotel is due to open this summer, using a concept combining luxury with contact with nature.

SANA Group also plans to open its latest 5-star hotel, the EPIC SANA Marquês, in Lisbon, in a €48-million investment. The unit’s inauguration is currently scheduled to occur in the first quarter of this year. The new unit is the result of the expansion and renovation of the 4-star EPIC SANA Lisboa Hotel. The EPIC SANA Marquês will have an additional 170 rooms, for a total of 379, along with an 18-room conference centre with capacity for 450 people.

Accor Hotels increased its portfolio in Portugal with the inauguration of the Mercure Fátima, thus maintaining its bet on Portugal. The 72-room hotel is located five minutes’ walk from the Sanctuary of Fatima, next to the Basilica of the Holy Trinity.

Lastly, the Dutch group Ten Brinke invested 18 million euros in building a hotel in Viana do Castelo. The development, which includes a hotel, supermarket and restaurant, will take place on the site of the former Somartis, a carpet company founded in the 1960s, which has since closed.